Last Updated October 6 · Alex Zweydoff, Allegiant Management Grop

Starting October 1, 2025, Florida landlords must follow House Bill 1015 (HB 1015) and Florida Senate Bill 948—often called the Florida Rental Flood Disclosure Law. The rule requires clear notice of flood risks before a lease gets signed. Owners and managers pick up new duties, and renters get more transparency. To be officially, Florida Statute 689.302.

What Is the Florida Rental Flood Disclosure Law (HB 1015)?

The law tells landlords to inform prospective tenants if a property sits in a FEMA flood zone or has a known history of flood damage. The flood risk disclosure disclosure needs to happen before the lease is executed and should be documented in writing.

Coverage is broad. It reaches residential homes, condos, apartment communities, and commercial rentals. The purpose stays simple: help renters understand risk so they can choose wisely.

Who Must Comply With Florida’s Flood Disclosure Law?

This real estate disclosures compliance falls on residential landlords, commercial owners, and property managers who handle leasing. If you rent property in Florida, you’re expected to provide the disclosure to every new tenant before signatures go on the lease.

Flood Disclosure Requirements for Florida Landlords

- Flood zone status: Say whether the unit or building is inside a FEMA flood hazard area. Find out how to check status.

- Flood history: Share any known prior flood damage—even small incidents.

- Tenant guidance: Offer practical steps tenants can take, like reviewing renter’s insurance options.

Keep the language plain. Put it in writing. Ask both parties to sign so records are complete.

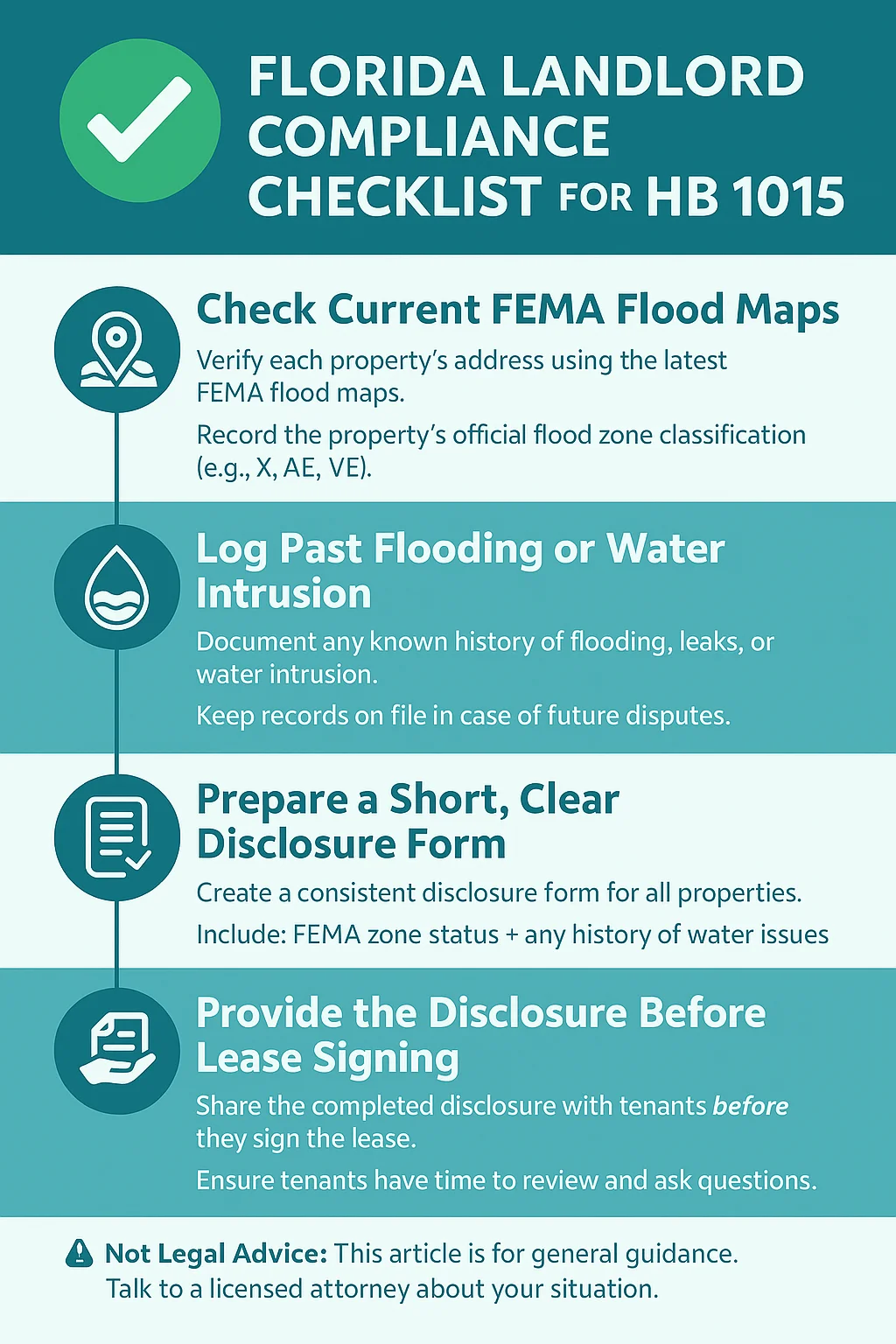

Florida Landlord Compliance Checklist for HB 1015

- Check current FEMA flood maps for every address you lease.

- Log any past flooding or water intrusion you know about.

- Prepare a short, clear disclosure form for each unit.

- Provide the disclosure before lease signing.

- File the signed disclosure with the lease packet.

Legal Consequences of Non-Compliance

Skipping the disclosure can lead to fines, lease termination rights for tenants, and potential lawsuits seeking damages. It can also hurt your reputation in the market.

Implications for Florida Tenant Rights

Renters now get important flood risk details before they commit. That makes it easier to judge safety, decide on insurance, and compare units without surprises.

Flood risk and rental laws in Florida can be overwhelming, but you don’t have to manage them alone. Allegiant Management Group provides full-service property management, helping landlords stay compliant, protect their investments, and keep tenants informed. Contact us today to learn how we can make managing your rental stress-free.

New Florida Flood Disclosure Form

Beginning October 1, 2025, landlords are legally required to provide prospective tenants with a separate flood disclosure form at or before signing any residential lease agreement lasting one year or more. This form must stand alone and cannot be included within the lease itself.

Watch Our Video About Disclosing Floods For Landlords

Frequently Asked Questions

- When does the Florida Rental Flood Disclosure Law take effect?

- The law takes effect October 1, 2025, and applies to new leases signed on or after that date.

- Does HB 1015 apply to existing leases?

- No. It is not retroactive and does not apply to leases executed before October 1, 2025.

- Which rental agreements are covered?

- Residential rental agreements with a term of one year or longer.

- What must landlords disclose under HB 1015?

- Landlords must disclose whether the dwelling is in a FEMA flood zone or known flood-prone area; any known flood damage during the landlord’s ownership; whether flood-related insurance claims were filed; and whether flood assistance such as FEMA or state aid was received.

- Does the disclosure need to be separate from the lease?

- Yes. The flood disclosure must be provided as a separate document at or before lease signing. It cannot be included within the lease language.

- What are the tenant’s rights if the landlord fails to disclose and flooding damages personal property?

- If a tenant’s personal property suffers substantial damage (50% or more of its pre-event market value) due to flooding and required disclosures were not truthfully provided, the tenant may terminate the lease by written notice and surrender possession within 30 days after the damage and receive a refund of prepaid rent for the unused period.

- Does the law apply to short-term rentals?

- No. HB 1015 applies to residential rental agreements lasting one year or longer, not to short-term or vacation rentals.

- How do landlords prove compliance?

- Landlords should keep a signed copy of the flood disclosure form with the lease documents for recordkeeping and proof of compliance.

- What is the new Florida rental law on floods?

- HB 1015 (paired with SB 948) establishes the new Florida Rental Flood Disclosure Law, effective October 1, 2025.

- What is the new flood disclosure form?

- It’s a required document that Florida landlords must provide starting October 1, 2025, informing tenants whether a rental property is in a flood zone or has a history of flood damage or claims.